Mar 24 2009

The Information Network proposes a 2-prong strategy for semiconductor equipment and materials suppliers to grow and survive now and when the current recession is over.

Strategy 1: Consolidation

There are about 40 metrology/inspection tool vendors that sold $4.6 billion in tools to the semiconductor market in 2007.

In stark contrast, there are 40 automobile manufacturers that sold 71.9 million automobiles worth $933 billion in 2007.

That’s an average selling price of $119 million per metrology/inspection vendor versus $23 billion per automobile manufacturer. A ratio of 1:200!

“Clearly the semiconductor equipment industry is overpopulated and needs to consolidate,” noted Dr. Robert N. Castellano, President of The Information Network. “As an example, the semiconductor lithography market is primarily comprised of 3 vendors sharing a $7.2 billion market in 2007.”

There has never been a better time than now for the semiconductor equipment (and materials vendors) to consolidate. Companies’ valuations are currently cheap, and ideally once the stimulus/tarp/talf programs kick in, valuations will rise, making the acquisition much more difficult.

Strategy 2: Raise Prices

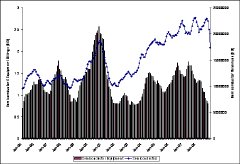

As shown in the figure, the semiconductor manufacturers have enjoyed sustained growth starting in September 2001 and ending in October 2008.

The equipment revenues however, have had periods of positive and negative growth during the same 7 years. The cyclical growth in this period was reminiscent of the previous 6 years except for the fact that semiconductor revenue growth diverged in 2001.

In a previous note we rationalized that the semiconductor went through a paradigm shift following the downturn in 2001 with respect to equipment purchases, but the main culprit was the shift to 300mm wafers, whereby 2.4 times the number of chips can be made on a 300mm wafer compared to a 200mm wafer for a piece of equipment costing about the same – for a one-time purchase.

Clearly, the equipment industry had not taken advantage of the once-bloated coffers of the semiconductor manufacturers and now needs to raise prices.

“Our leading indicators, which accurately forecasts semiconductor equipment inflection points, indicate that there will be no upturn through June 2009,” added Dr.. Castellano.

That is why The Information Network proposes a 2-prong strategy for equipment (and materials suppliers). The consolidation process will naturally reduce the number of vendors and will drive up prices. The remaining vendors must band together and raise prices further to increase their revenue stream and not cow-tow to purchasing agents pleading for price consideration.

In fact, the equipment suppliers should form an association to fight for their needs.