Oct 14 2009

According to a new technical market research report, THE PLASTICS COMPOUNDING MARKET (PLS018C) from BCC Research, North American companies will distribute an estimated 91 billion pounds of thermoplastic compounds in 2009. That is expected to increase to 107 billion pounds in 2014, for a 5-year compound annual growth rate (CAGR) of 3.3%.

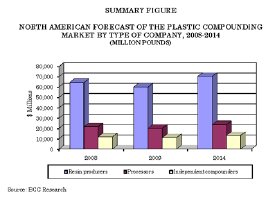

The market is broken down into resin producers, processors, and independent compounders. The resin producers segment has the largest share of the market, distributing an estimated 60 billion pounds of compounds in 2009. The segment is expected to grow at a CAGR of 3.2% to reach 70.2 billion pounds in 2014.

The processors segment has the second-largest share of the market with 20 billion pounds distributed in 2009. That figure is expected to increase to 23.6 billion pounds in 2014, for a CAGR of 3.4%.

Independent compounds are expected to distribute nearly 11 billion pounds in 2009. The segment is expected to grow at a CAGR of 3.7% to reach 13.1 billion pounds in 2014.

The production of compounded plastics is highly competitive. Competition is based on many factors, including speed, delivery, service, performance, product innovation, product recognition, quality and price.

Resin producers take a bigger role in markets where significant proprietary technology is involved, such as is increasingly the case for flame-retardant engineering thermoplastics for the electrical/electronics market.

This report covers the major thermoplastic resins and thermoplastic elastomers (TPEs). It also includes bio compounds - plastics that are made from plants instead of hydrocarbons.

The study is also the first to address critical issues that will shape plastics compounding for the next 5 years - bio compounds, carbon fiber, carbon nanotubes, natural fiber reinforcements, and environmental regulations.