The global market for elastomers is expected to reach more than 28.1 million tonnes in 2012, and is estimated to grow by 18.5% to reach 33.3 million tonnes in 2017, according to a new study by Smithers Rapra.

Source: Smithers Rapra, Emerging Applications for Elastomers to 2017.

Source: Smithers Rapra, Emerging Applications for Elastomers to 2017.

The elastomers market consists primarily of natural rubber (NR) and a collection of various synthetic elastomers. NR occupied 39% of the total global elastomer consumption in 2012 and will continue to dominate the market, although it will slightly decline to 38.1% in 2017. Despite advances in the development of synthetic elastomers, NR remains irreplaceable and will continue to be so for a long time to come.

Emerging Markets for Elastomers to 2017 covers the market for natural rubber and 12 separate classes of synthetic elastomers, of which each has an important role to play. The markets by elastomers are considered more important than the individual applications because it is very clear that the Asia/Pacific regions will all grow much faster than the established industrial nations. This new report provides in depth figures on the elastomers market, broken down by geographic region, and provides an up-to-date view of the current and future states of the market.

The compound average growth rates of many elastomers are increasing at below average rates, such as NR and Emulsion Styrene-butadiene rubber (E-SBR), while others are increasing at between 22.8 and 37.8 percent. This reflects the increasing and decreasing roles that certain elastomers are now playing.

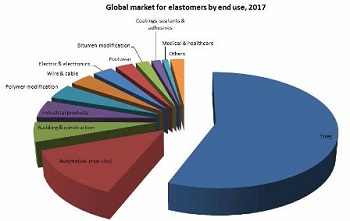

The major driver of the global elastomer market is the vehicle tire market. It represents 55.2% of the 2012 market and is expected to increase to 56.1% by 2017. This is due to the increasing demand for vehicle tires in Asia, which is a result of increased production of motor vehicles in this area. The non-tire market is the second dominating force, with 13.9% of the total 2012 consumption; this is expected to decrease slightly to 13.5% in 2017. In total, the automotive tire and motor vehicle market represents 69.1% in 2012 and will see a slight increase to 69.6% in 2017.

Other important global elastomers markets are building and construction, which will suffer a slight decline from 5.9% to 5.5% of the total consumption. However, this situation could change if increased investments are made in this section. This will depend greatly on the global markets recovering from the current economic crisis. Nevertheless, markets outside the tire sector that will grow positively (above average CAGR) are wire and cable, electrical and electronics and medical and healthcare.

Tire and automotive markets are the strongest in the Asia/Pacific region, with China leading with the largest production of both tires and motor vehicles (52%) in the world. It is estimated that the number of passenger and light commercial vehicles in the world was just over one trillion in 2010. This is expected to be 1.2 trillion in 2015. Thus, the number of these vehicles is expected to be 20% more in 5 years. China will continue to hold its position for the next 10 years and at least 69% of the consumption of elastomers is currently dedicated to the tire and vehicle industry. By contrast, medical and healthcare applications are strongest in Europe and the NAFTA region, but the Asia/Pacific region is quickly catching up.

Emerging Markets for Elastomers provides in depth information regarding elastomers in the field of tires; non-tire automotive; building and construction; industrial products; polymer modification; wire and cable; electric and electronics; footwear; bitumen modification; coatings, sealant and adhesives; and the medical and healthcare field. The report is available for £3950, but has a pre publication price of £3555 before November 30, 2012. For information, please contact Bill Allen at 44 1372 802086 or via email at[email protected].