Semiconductor sales appear to be finally emerging from the red this year, with moderate but steady growth of 5.1 percent projected through 2014, according to World Semiconductor Trade Statistics' Spring 2013 global semiconductor sales forecast.

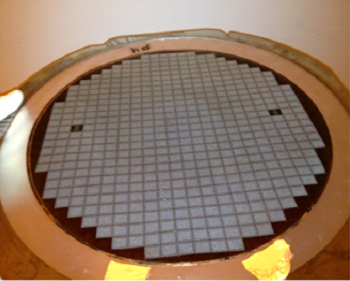

Courtesy of Dow Corning.

Courtesy of Dow Corning.

While a revival in end-market demand is sparking much of this growth, Dow Corning, a global leader in silicones, silicon-based technology and innovation, sees collaborative advances in materials and processing technologies as a sustaining force in the industry's recovery.

"The pace of innovation across the semiconductor processing and packaging value chain has never been greater and, while the industry hasn't reported any insurmountable challenges ahead for advancing such promising technologies as 3D IC integration, several critical needs are emerging among our global semiconductor customers that we are addressing head on," said Andrew Ho, global industry director, Advanced Semiconductor Materials at Dow Corning. "Among these needs are the steadily accelerating demand for high-performance silicone solutions to help collaborators along the value chain to manage the impact of heat and stress, while reducing overall systems costs wherever possible."

Specifically, Dow Corning sees growing demand for innovative new silicone solutions able to address the following industry-wide challenges:

- Improved heat management: The trend toward ever-smaller devices with more densely packed electronic components is coinciding with the expanding use of flip chip and stacked die architectures. As a result, the industry is seeking improved thermal management from advanced silicone technologies that effectively dissipate heat and deliver greater device reliability and longer life.

- Enhanced stress passivation: The rapid growth of wafer-level packaging and power electronics is posing new manufacturing challenges for stress mitigation. At issue is thermo-mechanical stress failure caused, in part, by conventional organic passivation materials. This has prompted new explorations in photopatternable silicone solutions that help minimize thermo-mechanical stress during processing, and deliver higher thermal stability and low temperature cure.

- Lower systems costs: Minimizing total cost of ownership is essential for all semiconductor manufacturing applications. But it is a key enabler for next-generation technologies, such as 3D IC integration built on ultra-thin active wafers. These wafers are temporarily bonded to a carrier wafer before being thinned; yet most temporary bonding solutions require costly pre-treatment and specialized chambers. Recent industry collaborations, however, have successfully fielded a simpler, more cost-effective temporary bonding solution based on silicone adhesive and release layers. The breakthrough technology now enables room-temperature bonding and debonding of active and carrier wafers using conventional manufacturing methods.

"After decades of serving the semiconductor manufacturing industry, Dow Corning recognizes that few if any companies can single-handedly anticipate the next-generation of semiconductor solutions," said Ho. "Our strong leadership position in this industry is directly linked to our long history of close collaboration with semiconductor manufacturers to develop breakthrough silicone technologies, and we are committed to continuing our history of proactively collaborating with customers to solve their most pressing challenges and help drive the industry forward."

Semiconductor sales appear to be finally emerging from the red this year, with moderate but steady growth of 5.1 percent projected through 2014, according to World Semiconductor Trade Statistics' Spring 2013 global semiconductor sales forecast. While a revival in end-market demand is sparking much of this growth, Dow Corning, a global leader in silicones, silicon-based technology and innovation, sees collaborative advances in materials and processing technologies as a sustaining force in the industry's recovery.