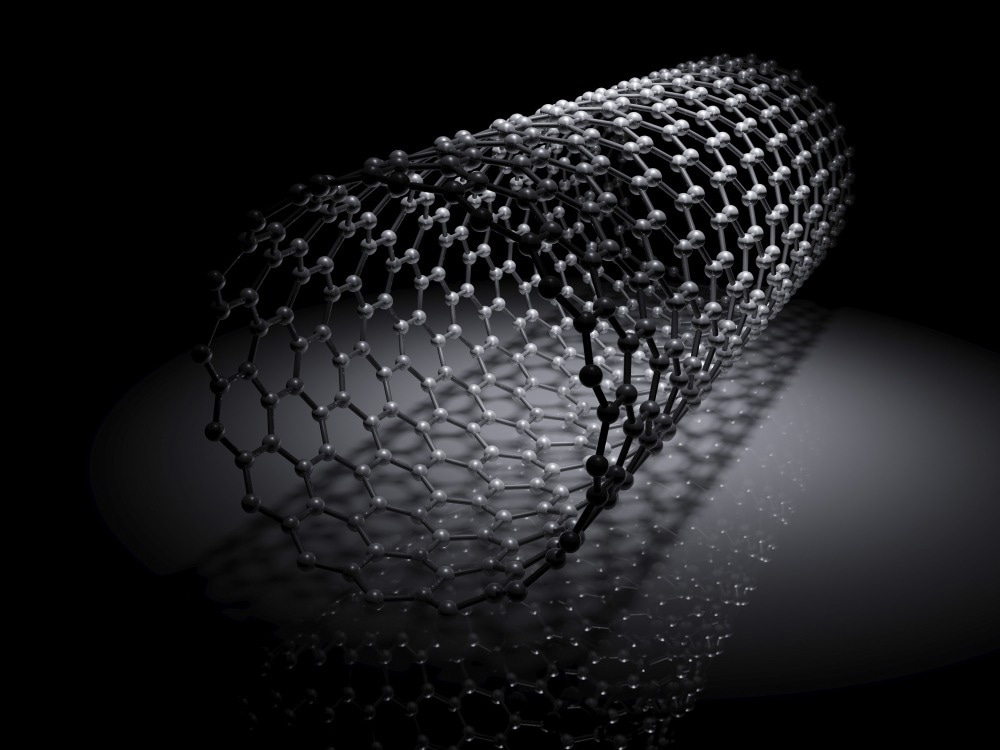

Nanomaterials remain a significant growth area with the potential to enable a wide range of next-generation technologies. Although the material is on a nanoscale, most manufacturers incorporate them into some form of intermediate to be used. An emerging area for nanocarbons is making "macro-scale" CNTs. This is a misnomer but is used to encompass CNT yarns, sheets, or veils.

Image Credit: Evannovostro/Shutterstock.com

IDTechEx has been investigating the nanocarbon industry for more than a decade. They have released the latest version of their CNT report, "Carbon Nanotubes 2022-2032: Market, Technology, Players", which includes granular 10-year volume and value forecasts segmented by end-use applications for both MWCNTs and SWCNTs, player profiles, and benchmarking studies. This article will focus on CNT yarns and sheets before expanding on to high-aspect-ratio and hybrid materials; these are all at an earlier commercial stage than the main MWCNT market.

The sheets or veils can either have the CNTs aligned or not, the latter usually being in the form of an entangled non-woven mat. These are not new to the market nor new developments, but the VACNT (vertically aligned carbon nanotube) sheets are gaining some notable traction. NAWA Technologies, fresh from completing a Series C funding round in early 2022 and acquiring N12 Technologies in 2020, are expanding their capacity mainly for energy storage applications. Carbice Corporation raised an eye-catching $15m Series A in late 2020 and are targeting the use of VACNTs for thermal interface materials. Outside of niche use-cases, this material family remains as a solution looking for a commercial problem, but given the developments, they should not be overlooked.

The CNT yarns continue to spark much excitement, an example being Kureha's 2022 investment, but are still to gain any of the commercial success that their properties promise. An ultra-strong, conductive fiber is an attractive proposal, and there are numerous production processes at various stages of TRL & MRL. Many commercial companies employing a spinning process can trace their roots back to Rice University, including DexMat, Conyar, and Wootz. The other main approach is a 1-step CVD process employed by the likes of Nanocomp, acquired by Huntsman in 2018, and Tortech. Beyond the manufacturing challenges, the question will remain about where there is a market pull beyond relatively niche space, sporting, and e-textile applications.

Other comparable areas should not be ignored, namely: very high aspect ratio nanotubes and hybrid products.

1. High-aspect ratio tubes: this refers to the relative length to the diameter of the nanotubes. Of course, nanotubes are not all the same, and finding the right ones for the right application are critical, but a recent trend has been towards making higher-aspect ratio variations. This is taken to the limits in academia, where the likes of Waseda University grow ultra-long forests on the scale of cm but is also being seen in commercial settings with the likes of Cabot Corporation producing what they term a carbon nanostructure (CNS) with a length of over 25 um. This CNS is being targeted for numerous areas but is stated to have good success for EMI shielding.

2. Hybrid products: Most CNTs are used as an additive and are rarely used in isolation, typically blended with other additives for the final product need. However, there is an option to combine alternative materials with CNTs prior to incorporation by forming a hybrid CNT. There is a large amount of academic interest, but on the commercial side, you can see examples like a Carbon Nanobud (CNB) from Canatu and a range of companies specializing in functionalizing CNTs. One of the most notable in hybrid CNTs is CHASM Advanced Materials, who make CNT products in conjunction with copper & silver, carbon black, graphite & graphene, and ceramics like silica and alumina. These are being targeted for a range of applications but to pick one is the work with Birla Carbon, who also invested in CHASM, for the work with carbon black. It was stated that they get the properties of CNTs, but with the usability of carbon black, as with all these hybrid materials, it is at an early stage but certainly one to watch.

For more details on all of these "macro CNTs" and a broader view of MWCNTs and SWCNTs, see the IDTechEx market report "Carbon Nanotubes 2022-2032: Market, Technology, Players". For more information on IDTechEx's other reports and market intelligence offerings, please visit www.IDTechEx.com/Research.