Electrification, autonomy, and vehicle ownership saturation are causing a technological revolution in the automotive sector. These automotive meta-trends are driving drastic changes in electronic component requirements and present a high-volume opportunity for printed electronics to capitalize on.

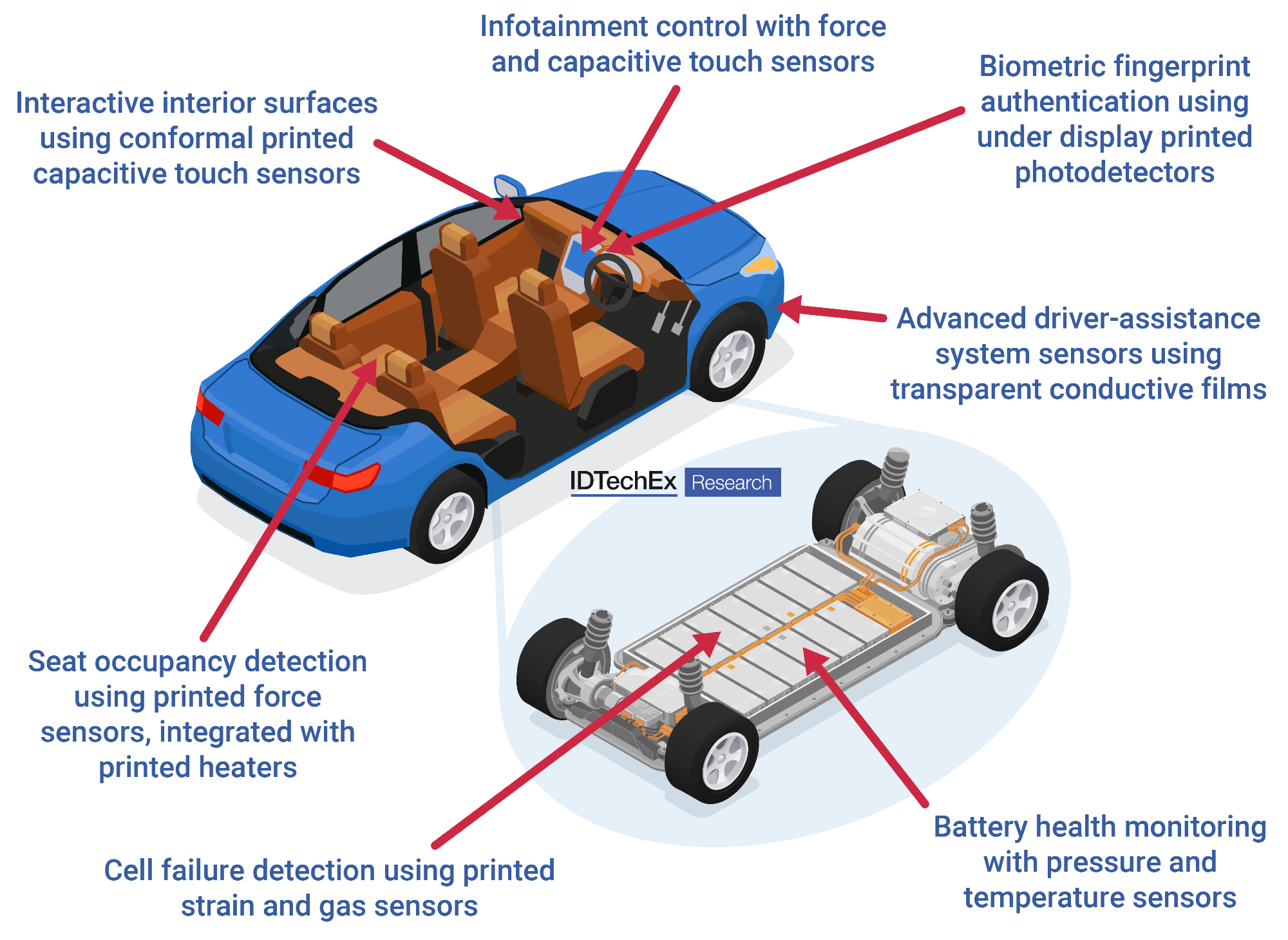

Emerging applications for printed and flexible sensors in automotive applications. Image Credit: IDTechEx

Emerging applications for printed and flexible sensors in automotive applications. Image Credit: IDTechEx

Historically, printed electronics technologies have nurtured a close relationship with the automotive sector, with printed force sensors pioneering passenger safety through seat occupancy and seatbelt detection. As such, the automotive sector continues to represent the lion's share of the global printed and flexible sensor market, which IDTechEx’s report on the topic evaluates as worth US$421M in 2024. However, if the automotive sector is to continue to be a reliable revenue stream, printed electronics technology providers must adapt to address the emerging technical challenges facing future mobility.

Augmenting Autonomous Vehicles with Printed Electronics

As vehicle autonomy levels advance, the increasing number and distribution of spatial mapping sensors required will need continuous performance improvements to ensure passenger safety. Emerging printed electronics technologies can augment these sensors, extending detection bandwidth and maximizing reliability during operation.

Transparent conductive films (TCFs) are being developed to heat and defog LiDAR sensor panels, ensuring the function is unperturbed by external environmental conditions. Properties such as high transparency and low haze are important for defogging. These properties can be easily tuned using the wide variety of material options available for TCFs, including carbon nanotubes and silver nanowires.

IDTechEx identifies printed heating as a leading application of transparent conductive films. This is attributed to diminishing growth prospects in capacitive touch sensing applications. Innovations in thin film coating techniques have enabled indium tin oxide (ITO) to dominate touch sensing applications, all but displacing TCFs completely.

Looking towards the future, printed electronics technologies could play a more active role in advanced autonomous driving. Emerging semiconductive materials, such as quantum dots, printed directly onto conventional silicon image sensor arrays can extend detection range and sensitivity deeper into the infrared region. Augmenting existing image sensor technology with enhanced spectral range could facilitate the competition of hybrid silicon sensors with established InGaAs detectors.

Printed Sensors Promise Granularized Battery Health Monitoring

Vehicle electrification is driving the sustained development and evolution of electronic management systems, particularly in the battery and electric drivetrain. A strong market pull exists for technologies that increase vehicle efficiency, range, and lifetime while reducing recharge times.

Printed pressure and temperature sensors measure battery cell swelling and thermal profiles, providing granularized physical data that can be used to optimize battery deployment and recharging. Moreover, hybrid printed sensors that combine integrated printed heating elements promise a solution to actively address battery temperature. IDTechEx estimates that printed sensor-enabled battery deployment and charging optimizations could be worth up to US$3000 in savings per vehicle.

There remains uncertainty about whether electrification trends will correspond to increased demand for physical sensors in electric vehicle batteries, owing to the utility of existing electronic readouts for managing deployment. Virtual sensors also pose a threat, where AI-enabled software models interpret data to predict and emulate physical sensor functions without the need for discreet components. However, emerging regulations regarding safety and sensor redundancy will likely favor measurable metrics and see automotive makers continue to adopt physical sensors. IDTechEx predicts that virtual sensors are unlikely to displace their physical counterparts – so long as low-cost sensors remain widely available.

Embedding Printed Electronics in the Car of the Future

IDTechEx predicts that global car sales will saturate over the next decade, with automakers increasingly looking for premium features and technical innovations to differentiate themselves from the competition. In-cabin technologies will be highly desirable – as the location where passengers reside and interact with the vehicle the most.

Lighting elements are emerging as a prominent differentiator, described as “the new chrome” by Volkswagen’s chief designer. The use of in-mold structural electronics (IMSE) enables the integration of embedded lighting elements using existing manufacturing processes. 3D electronics technologies are intrinsically attractive for automotive integration, as functional layers are conformable and lightweight while easily embedded within existing aesthetic elements.

Despite strong tailwinds, the adoption of in-mold electronics within automotive interiors has been sluggish. This is attributed to the challenges of meeting automotive qualification requirements, as well as stiff competition with less sophisticated alternatives such as applying functional films to thermoformed parts. Nevertheless, momentum is building, with technology providers like Tactotek partnering with Mercedes-Benz and Stallantis to progress the automotive validation of IMSE to TRL5.

Outlook for Printed Electronics in Automotive Applications

Just as printed force sensors heralded early passenger safety systems, printed electronics technology is poised to underpin next-generation innovations for the car of the future. But this time, the competition will be stiff. Critical cost requirements must be met, while desirable new functionality must address existing challenges faced by manufacturers. Printed electronics can play a role in supporting emerging electrified and autonomous mobility, such as augmenting LiDAR sensors or optimizing electric battery deployment. Demand for technologies that enhance passenger experience and vehicle aesthetics will continue to grow, and printed electronics can supply low-power, lightweight lighting solutions for these.

Sustained engagement from tier suppliers and manufacturers continues to make the automotive sector key to printed sensor market growth opportunities – a total market IDTechEx predicts will reach US$960M by 2034. Strong partnerships between material providers and printed electronics technology providers are complementary to those of the highly vertically integrated automotive value chains between tier suppliers and OEMs. Leveraging printing techniques to provide solutions that slot into existing manufacturing processes and designs will be crucial. In the medium term, the printed electronics technologies most likely to realize revenue potential are those that can adapt to service emerging challenges already known to the automotive industry.