Electric vehicles (EVs) were a dream casting a vision of the future not so long ago. Yet today, major global automotive manufacturers offer at least one EV in their product line, and all are accelerating their efforts in the research, development and production of EVs.

Market analysts believe that electric vehicles will soon dominate the automotive market like how smartphones revolutionized the mobile phone market around a decade ago.

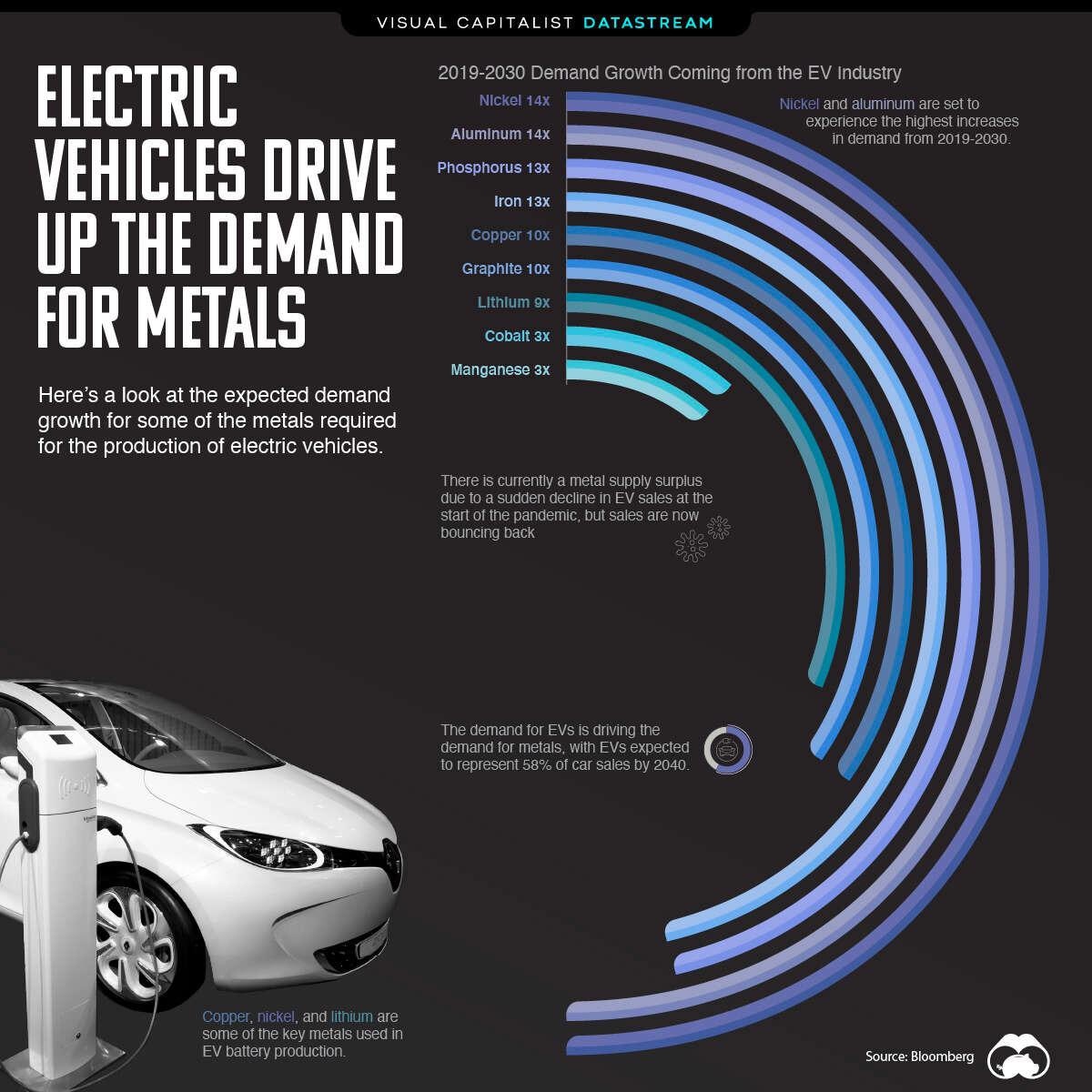

Current predictions state that by 2040, EVs will make up more than 50% of passenger vehicle sales. The principal driving factor for the move to EVs is to limit and curb the harmful emissions that currently contribute to global warming.

One of the main development objectives of EVs is making them as efficient as possible to boost the driving range on a single battery charge. Reducing the total weight of the vehicle has a significant impact on efficiency, and manufacturers are searching for alternative, light-weight materials for the chassis and car body.

Impact of the Electric Vehicle Industry on Demand for Key Metals

Aluminum, copper and nickel are considered key metals for EVs, and it is anticipated that the demand for these metals will increase in parallel with the rise of EV sales.

Although like the rest of the automotive industry, electric vehicle sales saw a decline in 2020 due to the pandemic, sales are now expected to rise sharply.

It’s not just car body materials that are expected to be in demand; the batteries that power EVs require copper, lithium, cobalt, manganese, nickel and graphite.

From 2019 to 2030, the demand for nickel is likely to have increased by a factor of 14. Similarly, it is anticipated that the demand for lithium and copper will undergo a tenfold growth.

The below image produced by Visual Capitalist displays the expected growth in demand for key metals used in EV production.

Image by Visual Capitalist

Aluminum: Metal of Choice

Aluminum – the metal coveted by electric vehicle manufacturers – is used across an extensive range of the vehicle’s body parts, including brakes, wiring, wheels and pipes. Aluminum is also a key material within the drive chain and is used for battery casings.

Aluminum alloys are critical for the development of EVs due to their characteristic low density that facilitates an overall weight reduction.

Typically, the automotive sectors use the AA5xxx and AA6xxx series of aluminum alloy. However, most of the main suppliers are currently developing the AA7xxx series of aluminum sheet alloys to satisfy the high strength requirements automotive OEMs demand.

Yet, the AA7xxx alloys (with the addition of zinc (Zn)) are expensive to fabricate and must overcome issues related to corrosion and stress.

Steel: Still in the Running

The high cost of aluminum, in contrast to steel, contradicts the aim of reducing the cost of EVs. Therefore, alternative advanced high strength steel (AHSS) are being used due to their strength, stiffness and capacity to absorb energy in the event of a crash.

As AHSS has such great strength, the thickness of the parts can be limited, helping reduce the weight. Most newer vehicle designs use AHSS over traditional steel, which brings down the weight by 25 – 39%. In a typical family car, this is equivalent to a weight reduction between 170 and 270 kg and saves about 3-4.5 tons of greenhouse gases over the vehicle’s lifespan.

Automotive manufacturers across the world are continuously innovating to find the alloy formula that optimally balances cost-effectiveness with safety and efficiency. Mild steels are quickly being replaced by high-strength steels (HSS), advanced high strength steels (AHSS) and other high-tech alloys.

Where Do Materials Analyzers Come in?

This significant shift in automotive engineering and manufacturing means that the exact specification of these new materials must be checked and confirmed throughout numerous stages of EV production.

From the initial inspection of raw materials to quality control throughout the entire manufacturing process, materials analyzers have a key role in ensuring the success of EV production cycles.

Hitachi High-Tech’s range of analyzers has been developed with specific applications in mind, from precision analysis of the metal composition of components to ppm-level melt. Hitachi’s analyzers can help to speed up any material testing programs, whether it be an automotive OEM or part of the general supply chain.

The OE series of spark spectrometers is perfect for the analysis of metals within EV development and production. With the latest detector technology, these are Hitachi’s most powerful spark spectrometers, offering a level of performance typically seen in more expensive instruments.

For example, the OE750 delivers exceptional analytical performance for carbon steels due to its ability to monitor the nitrogen content in steel and iron casting processes at extraordinarily low levels. The instrument can identify all other trace elements within steel and provides trusted results for all major alloying elements.

Aluminum foundries that supply the automotive industry must conduct aluminum melt analysis at the highest level possible. For instance, phosphorus (P), calcium (Ca), bismuth (Bi) and antimony (Sb) tramp elements must not exceed 120 ppm in total, as this would invalidate the effects of introducing other elements to manage the melt properties.

Both analyzers within the OE series have been developed to meet these demanding requirements, making them optimal for aluminum production.

For the analysis of nickel and nickel alloys, the latest detector technology within the OE series allows these instruments to identify all types of nickel alloys and track the nitrogen content throughout the casting process.

They will also detect other trace elements, including lead and tin, and provide trustworthy results on all major alloying elements.

Hitachi High-Tech analyzers offer simple calibration and include self-checking software that guarantees accurate results and delivers advanced, cloud-based data management to make compliance and auditing a straightforward process.

It is important to schedule regular maintenance for a car, and the same is true of valuable instruments.

Hitachi strives to keep downtime to a minimum with responsive customer support. Offering onsite or remote support, flexible service agreements and analyzer audit Hitachi has a firm grip on establishing a long-term relationship that helps to keep businesses running.

For additional information on the OE series for specific metal applications, contact Hitachi today, or arrange a demonstration using the links below.

This information has been sourced, reviewed and adapted from materials provided by Hitachi High-Tech Analytical Science.

For more information on this source, please visit Hitachi High-Tech Analytical Science.