Oct 13 2017

Over the years, there has been a significant increase in the production of electric vehicles combined with the fact that the use of grid-connected battery systems for storing the electricity generated from renewable sources is also expected to grow considerably.

These factors raise an important question: Are sufficient raw materials available to allow considerably increased production of lithium-ion batteries, which are regarded as the leading type of rechargeable batteries on the market?

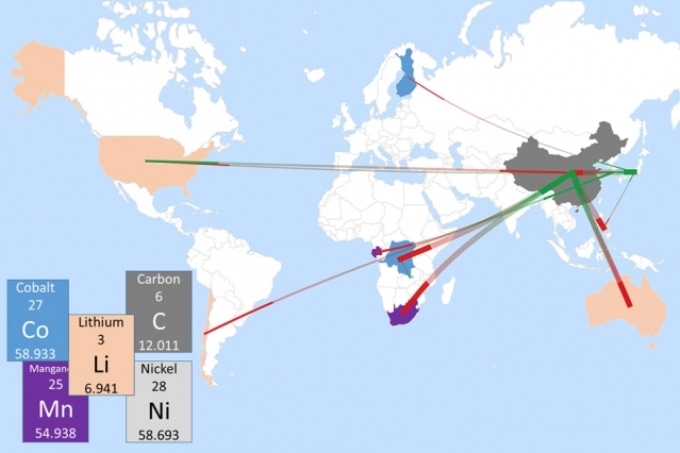

A new analysis indicates that, without proper planning, there could be short-term bottlenecks in the supplies of some metals, particularly lithium and cobalt, that could cause temporary slowdowns in lithium-ion battery production. This map shows today’s trade flows of key ingredients for battery production, with exports from each country shown in red and imports in green. (Credit: MIT)

A new analysis indicates that, without proper planning, there could be short-term bottlenecks in the supplies of some metals, particularly lithium and cobalt, that could cause temporary slowdowns in lithium-ion battery production. This map shows today’s trade flows of key ingredients for battery production, with exports from each country shown in red and imports in green. (Credit: MIT)

A new analysis by MIT Researchers and elsewhere suggest that in the coming days, shortages of important metals will have no absolute limitations on the production of batteries. However, improper planning may lead to temporary bottlenecks in the supplies of certain metals, especially cobalt and lithium that could temporarily slow down battery production.

Professor Elsa Olivetti and Doctoral Student Xinkai Fu in MIT’s Department of Materials Science and Engineering, Gabrielle Gaustad at the Rochester Institute of Technology and Gerbrand Ceder at the University of California at Berkeley proposed the analysis, which was published in the journal, Joule.

Olivetti, the Atlantic Richfield Assistant Professor of Energy Studies, informed that editors of the new journal asked her to explore the potential resource limitations as battery manufacturing rises dramatically worldwide. To accomplish that, Olivetti and her Co-authors focused on five of the most crucial ingredients required to develop modern lithium-ion batteries – cobalt, lithium, manganese, carbon and nickel in the form of graphite. Aluminum, copper and certain polymers used as membranes are other major ingredients that are not likely to be a limiting factor, since these are believed to be abundantly available.

Among the five materials, it became instantly apparent that manganese and nickel are used much more extensively in other industries. The production of batteries, even if considerably increased, is, “not a significant part of the pie,” says Olivetti and therefore supplies of manganese and nickel are not likely to be affected. In the end, cobalt and lithium are the most significant materials whose supply chains could become limited, she says.

For these two elements - cobalt and lithium - the team studied the diversity of the supply options in terms of production facilities, geographical distribution and other variables. With regard to lithium, mining and processing of brines are the two important pathways to production.

Olivetti said that among these two pathways, production from brine can be increased to meet the demand much more quickly, within a period just six or eight months, as opposed to bringing in the latest underground mine into production. While disruptions might still be there in the lithium supply, these may not considerably affect battery production, she stated.

One element that is a bit more complex is cobalt, but its main source is the Democratic Republic of the Congo, which has a history of corruption and violent conflict. “That’s been a challenge,” Olivetti says. Cobalt is generally produced as a byproduct of other mining activities.

Often a mine’s revenue comes from nickel, and cobalt is a secondary product.

Professor Elsa Olivetti, Department of Materials Science and Engineering, MIT

However, the major potential cause of delays in acquiring new supplies of cobalt comes from the actual extraction infrastructure, and not from its inherent geographic distribution. “The delay is in the ability to open new mines,” she said. “With any of these things, the material is out there, but the question is at what price.” In order to protect against potential disruptions in the cobalt supply, Researchers, “are trying to move to cathode materials [for lithium-ion batteries] that are less cobalt-dependent.” stated Olivetti.

The research looked out over the next 15 years, and within that period, there are probably some bottlenecks in the supply chain, but no major barriers to meeting the growing demand, Olivetti said. Still, ,“it’s important for stakeholders to be aware of the bottlenecks,” because unexpected disruptions in the supply chains could affect a number of companies. Companies should think about alternative sources, and, “know where and when to panic, ”she stated.

In addition, a detailed understanding of which types of materials are most subject to disruption may help guide study directions, in deciding “where do we put our development efforts. It does make sense to think of cathodes that use less cobalt,” Olivetti said.

Overall, she said, “in most cases there are reasonable supplies” of the critical materials, “but there are potential challenges that should be approached with eyes wide open. What we tried to present is a framework by which to think about these challenges in a bit more quantitative way than you usually see.”

The National Science Foundation funded the study.