The materials industry is sometimes described as conservative, but digital transformation is well underway in the sector. Materials informatics - the application of data-centric approaches, including machine learning, to materials R&D - has the potential to be the most impactful arm of this process.

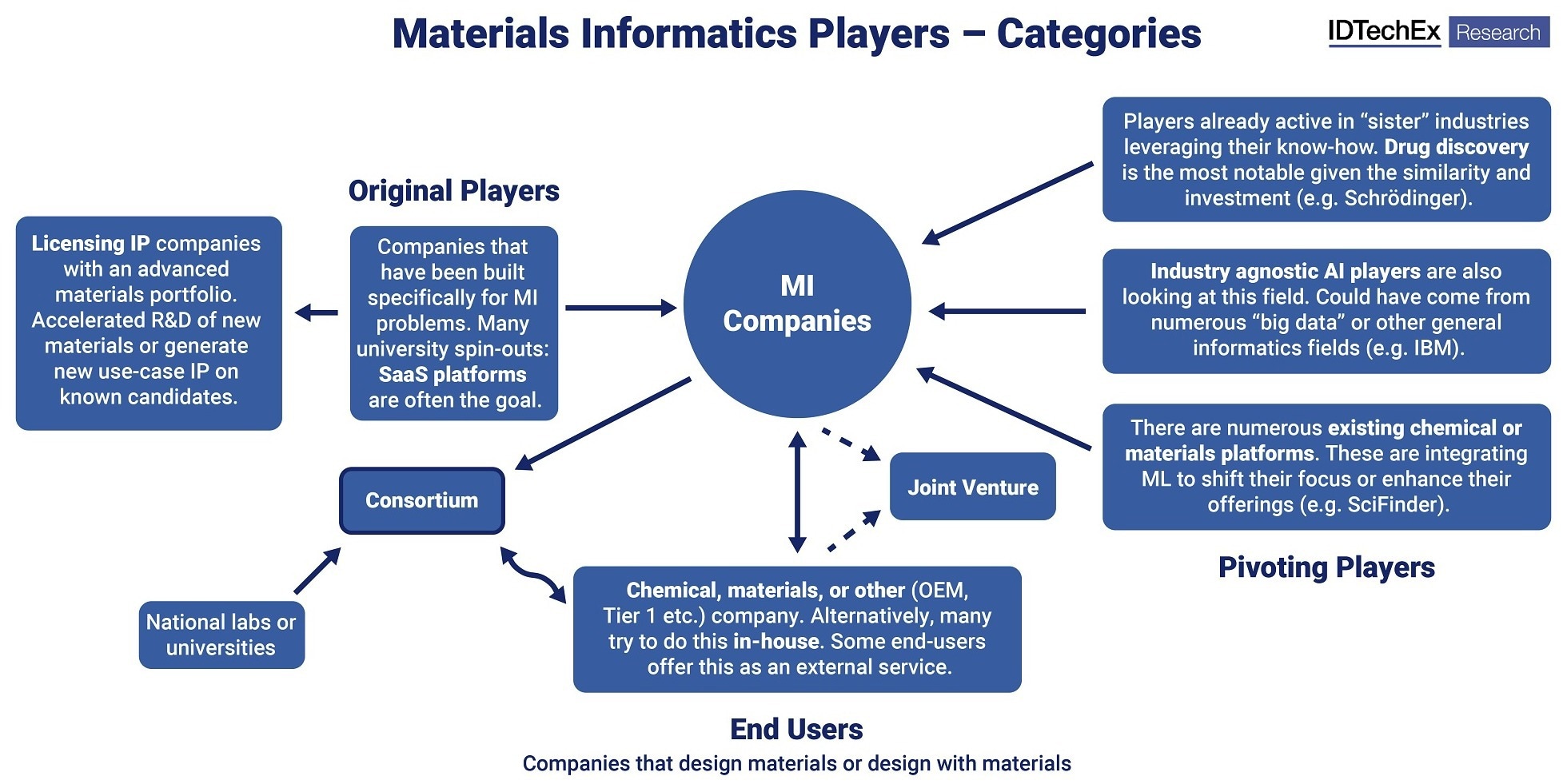

IDTechEx's report segments end-users of materials informatics into the above categories, weighing up the benefits of different strategic approaches. Image Credit: IDTechEx

IDTechEx's report segments end-users of materials informatics into the above categories, weighing up the benefits of different strategic approaches. Image Credit: IDTechEx

Not only can materials informatics (MI) accelerate the "forward" direction of innovation (properties are predicted for an input material), but sometimes even the idealized "inverse" direction (materials are designed given desired properties). Given its potential to revolutionize materials development, it is little wonder that IDTechEx forecasts the market for the provision of external MI services to grow at 13.7% CAGR by 2033.

During research interviews for their recent report "Materials Informatics 2023-2033", industry insiders frequently told IDTechEx that a core problem in developing an MI solution is that materials scientists are rarely data scientists and vice versa. As a firm newly looking to employ MI, buying into a SaaS (software-as-a-service) platform from an external provider is often an attractive approach to bridging this gap, giving materials scientists a pre-built architecture to develop their own MI projects within.

A full toolkit, from data gathering to machine learning analysis to visualization of results, is often given to users of these platforms, sometimes with little to no need to employ coding skills. This might sound like a magic bullet - why, then, are SaaS platforms not the universal approach to MI?

Using a SaaS package for MI projects lowers skill barriers, allowing companies that may not otherwise have had the internal expertise to apply machine learning to materials development. This, surprisingly, is not universally seen as beneficial. Materials giants with sufficient resources may prefer to build their own internal skillsets, software, and platforms as part of their own custom-tailored digital transformation - specialist consultancy firms like Enthought even exist to aid in the task. These giants may feel they are able to differentiate and break new ground beyond what is possible with an off-the-shelf platform. Given the diverse range of problems within materials science, it could be argued that a targeted approach is sometimes more valuable than a one-stop shop, despite the higher investment required.

3M has been particularly public about its efforts in this area, with the company saying this forced it to overhaul its approach to data infrastructures and has yielded positive results with adhesive formulations. A few major players, like Hitachi, have even chosen to deploy their own internally developed MI platforms to other firms via a SaaS approach.

Of course, multibillion-dollar giants also employ SaaS platforms: two cherrypicked examples include LyondellBasel working with Citrine Informatics and TotalEnergies with Uncountable Inc. When interviewed, both Citrine and Uncountable told IDTechEx that they are seeing increasing interest in MI services from industry titans, likely as a scramble continues to not get left behind in the race for digital transformation. Some of these players could even be looking to acquire SaaS providers to internalize their expertise.

This speaks to another reason that not everyone trusts buy-in to a SaaS platform: if a SaaS provider ceases trading, newly-ingrained methods of working with materials data could suddenly become useless. Furthermore, despite extensive efforts by MI SaaS providers to demonstrate their data security expertise, some materials firms may still struggle to trust these companies to handle the data that has become their most valuable commodity.

MI SaaS players are aware of these potential headwinds, with most choosing to meet them head-on. However, some are choosing an alternative approach: Kebotix, whose ChemOS-Pro software offers an "operating system for self-driving labs", is pivoting towards generating its own materials IP, switching its target customers from the materials and chemical industries to OEMs. This shifts more of the value chain into the company's hands but exposes it to greater project risk and increases capital requirements since it now must conduct experimental work and product qualification itself. This has not stopped firms focusing on this approach from raising large amounts of capital, with OTI Lumionics raising US$55M in October 2022.

SaaS platforms are likely to remain the first port of call for many that look to add machine learning into their materials development pipelines, but the alternative approaches briefly discussed here are just some of the many strategies outlined in IDTechEx's report "Materials Informatics 2023-2033", which is now in its third edition since IDTechEx began covering the field in 2020. Informed by first-hand interviews with the industry's major players, the report provides market forecasts, player profiles, investments, roadmaps, and comprehensive company lists, making this essential reading for anyone wanting to get ahead in this field.