Bipolar plates form the backbone of proton exchange fuel cells and consequently capture a significant portion of the fuel cell stack value, with IDTechEx forecasting their market value to exceed US$2.4 bn by 2033. A major talking point for bipolar plates is the choice of material – metal or graphite – with both alternatives holding the upper hand for certain applications. However, an often-overlooked aspect of bipolar plates is the various manufacturing routes available. In this article, IDTechEx discusses some of the different options and the seemingly inevitable convergence to roll-to-roll production methods in order to reduce manufacturing costs.

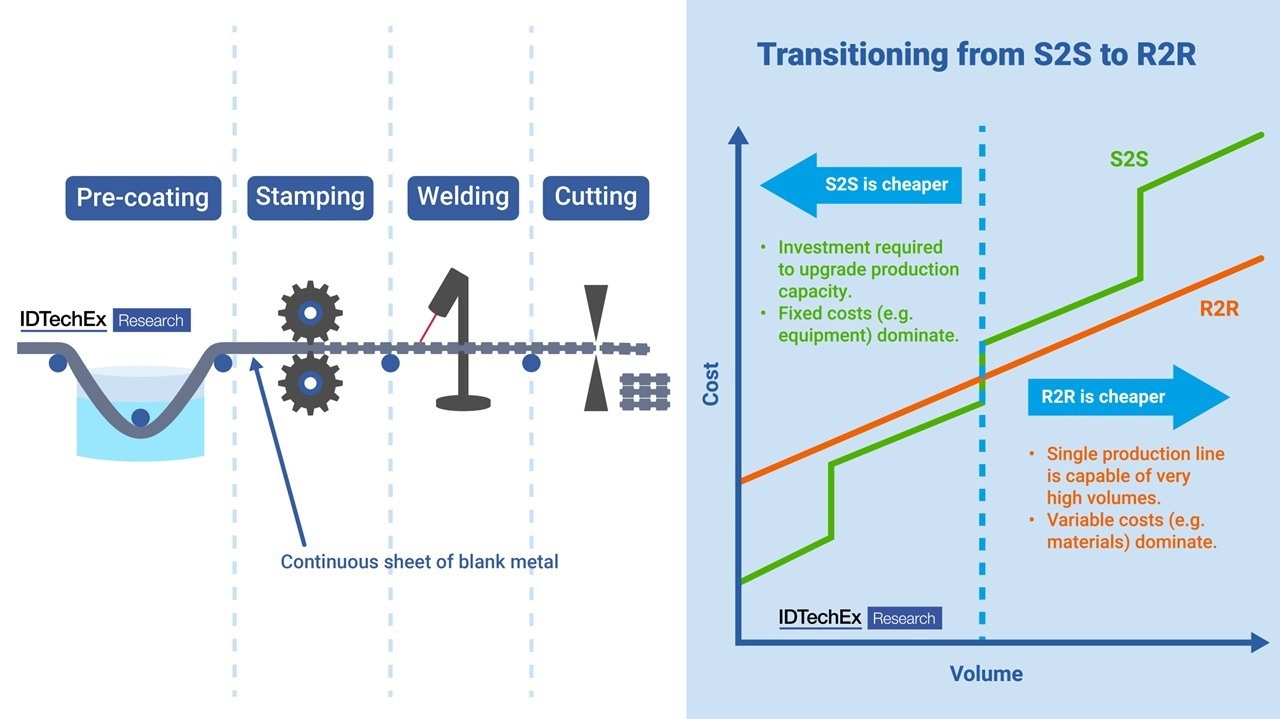

A schematic of a continuous roll-to-roll (R2R) production method for bipolar plates alongside an analysis of the transition from sheet-to-sheet (S2S) to R2R production. For further information on bipolar plates and other key fuel cell components, please see the IDTechEx report "Materials for PEM Fuel Cells 2023-2033". Image Credit: IDTechEx

A schematic of a continuous roll-to-roll (R2R) production method for bipolar plates alongside an analysis of the transition from sheet-to-sheet (S2S) to R2R production. For further information on bipolar plates and other key fuel cell components, please see the IDTechEx report "Materials for PEM Fuel Cells 2023-2033". Image Credit: IDTechEx

The new IDTechEx report, "Materials for PEM Fuel Cells 2023-2033", provides a comprehensive technical overview of bipolar plates and other key components for PEM fuel cells, an assessment of the major providers of bipolar plates, and also includes granular 10-year market forecasts for key fuel cell components and materials in terms of both units and volume. IDTechEx has also extensively covered the electric vehicle industry and forecasts demand for fuel cell electric vehicles (FCEVs) in "Fuel Cell Electric Vehicles 2022-2042".

Bipolar plates (BPPs) carry out a number of crucial roles in the fuel cell; not only do they provide structural support to the cell, but they also keep oxygen and hydrogen gas separated while simultaneously gathering the current generated in the cell. Given the broad range of roles for the BPP, various parameters must be considered when choosing the material for the plate, such as mechanical strength, corrosion resistance, conductivity (both electrical and thermal), and material costs. In the report, IDTechEx benchmark graphite and metal BPPs, the two most dominant material choices, and also provide an in-depth analysis of component suppliers, their manufacturing methods, and supply chain agreements with OEMs.

The distribution of gases throughout the fuel cell depends on the form factor of the channels (flow field) in the BPP that allow gas flow. One of the principal battlegrounds for BPPs is choosing an appropriate method to impart the flow field channels into the plate. Machining is a method typically carried out via a computer-guided CNC machine that mechanically removes material to form the flow field. Difficulties arise in the post-fab process, such as removing unwanted burrs and the necessity of a complex coating process, with fewer manufacturers in this area. Stamping is the dominant method for the formation of BPPs, also referred to as compression molding for graphite-based plates. Coatings can be applied before stamping, but care must be taken not to introduce defects to the coating as this can lead to pinhole corrosion of the plate. Laser welding seals any gaskets or other miscellaneous items to the BPP.

The cost point of each component must be reduced for the widespread adoption of fuel cells, but this is particularly relevant for BPPs, which will account for over 30% of the fuel cell stack value in 2033, according to IDTechEx research. As with all production methods, economy of scale should facilitate this cost reduction, but it should be seen that the move to roll-to-roll (R2R) production will play a key role in reducing the costs of fuel cells. A schematic of an R2R production method for BPPs is shown, in which variable costs, such as procuring materials, will dominate. By comparison, investment in manufacturing equipment is required to upgrade sheet-to-sheet (S2S) manufacturing. Some early moves have been made in this space, with Schaeffler partnering with Symbio to establish Innoplate. The joint venture will have an initial capacity of 4 million coated metal plates when production starts in early 2024 and is targeting to produce in the order of 50 million plates by 2030.

Parallels can be drawn with manufacturing methods for gas diffusion layers (GDLs), another key component for PEM fuel cells. The GDL is a porous medium facilitating the transfer of reactants (hydrogen, oxygen) and products (water) to and from the catalyst layer. It is typically made from carbon paper and also offers structural support to the membrane electrode assembly (MEA). There are up to ten stages in the manufacturing process for GDLs, all typically carried out in one continuous R2R procedure. Leading suppliers of GDLs operate at line speeds of up to 10 m/min. Following the development of an R2R system, the current limit to cost reduction depends on labor costs, including quality control.

Returning to BPPs, are there alternatives to the seemingly inevitable switch to a continuous R2R process based on stamping or compression molding? Etching, both photochemical and laser, is a relatively new and novel technique for the production of BPPs and allows for rapid prototyping with techniques drawn from the semiconductor components industry. Just as for machining, a complex coating process is required to avoid corrosion for metallic BPPs, while the methodology is not well suited to graphite plates. Bramble Engineering are pioneering a unique technique for the production of BPPs based on printed circuit board technology that is touted as "instantly scalable" based on existing manufacturing procedures. Bramble expects their product to conclude testing and achieve commercialization by 2025 before licensing the technology to OEMs. Despite these emerging alternatives, IDTechEx expects more traditional manufacturing techniques to dominate in the mid-term and retain a significant portion of the market in the long term.

For more details on the materials demand, trends, and emerging novel alternatives to the incumbents for PEM fuel cells, please see the IDTechEx market report "Materials for PEM Fuel Cells 2023-2033".