IDTechEx‘s new report “Semiconductors for Autonomous and Electric Vehicles 2023-2033” finds that the coming mass adoption of electric vehicles will drive a 10-year CAGR of 20.9% in semiconductors used for electric powertrains. Along with the rise of more autonomous vehicles, this will drive the overall automotive semiconductor market to a CAGR of 9.4% over the next decade.

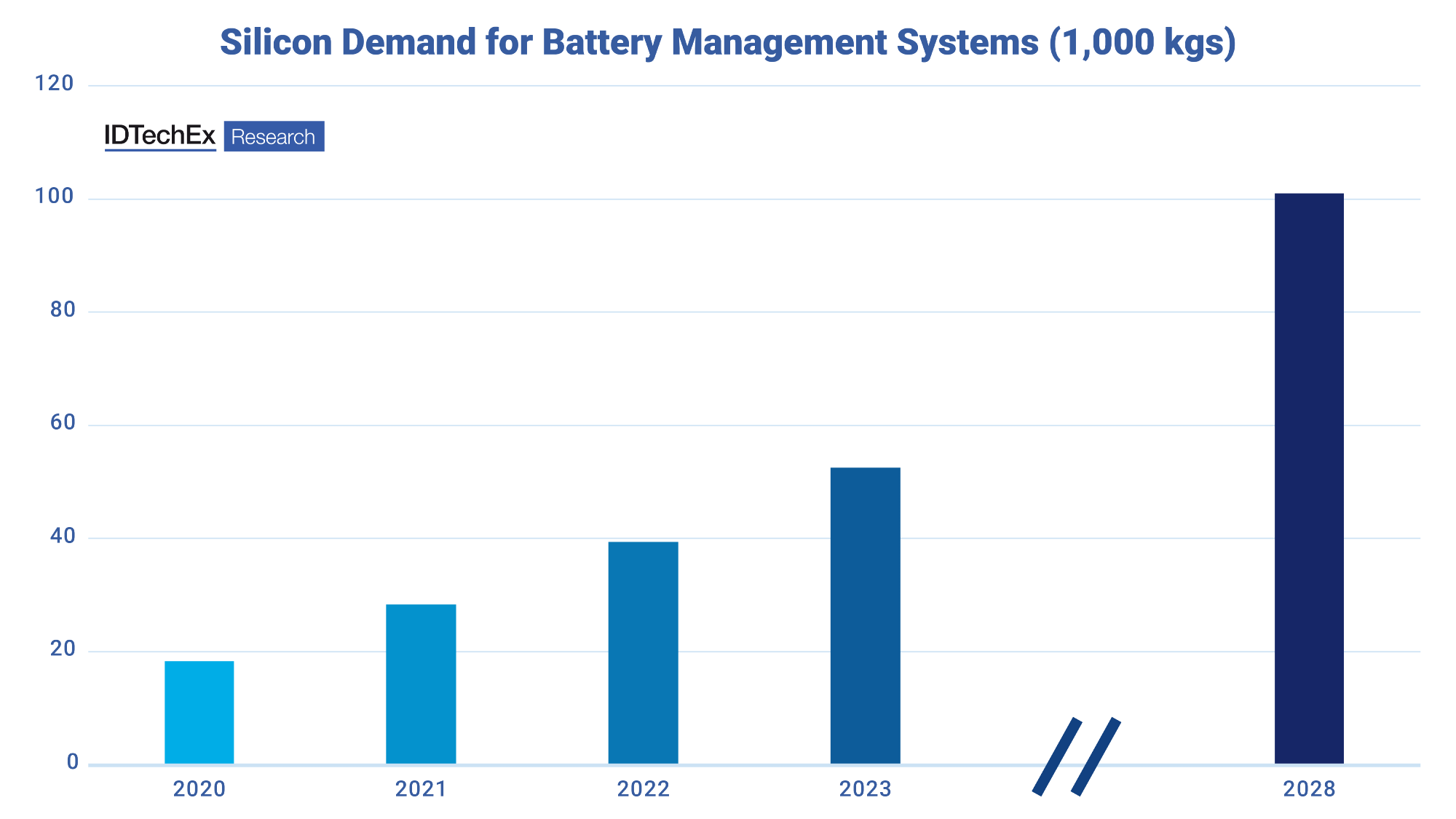

Silicon demand for battery management systems in electric vehicles. Source: IDTechEx

Silicon demand for battery management systems in electric vehicles. Source: IDTechEx

It is no secret that electric vehicles are the future, with growing pressure to decarbonize felt strongly in the automotive industry. This is reflected in recent electric vehicle sales figures, which, since around 2020, have seen exponential year-on-year growth indicating a transition from an earlier adopter technology to a mainstream one. As a result, IDTechEx predicts a 15% CAGR in the battery electric vehicle market over the next decade.

Semiconductor Components in Electric Vehicles

Semiconductor technologies have become engrained in internal combustion engine vehicles, with microcontrollers (MCUs) coordinating the mechanical, explosive ballet in a way that returns the most miles from each drop of fuel. However, managing the flow of electricity to and from the battery in an electric vehicle requires significantly more semiconductor administration in the form of power electronics. Silicon (Si) and silicon carbide (SiC) devices used for onboard chargers, inverters and dc-dc converters play a key role in the operation of electric vehicles and make up a significant proportion of the semiconductor value in the vehicle.

Big power electronics components like the inverter make up a considerable chunk of the value that goes into building an electric vehicle. But IDTechEx’s “Semiconductors for Autonomous and Electric Vehicles 2023-2033” report goes down to the level of individual chips and wafers. From this perspective, the battery management system (BMS) becomes a surprisingly large contributor to silicon demand in electric vehicles.

Within the battery management system, there are two main types of chips, one master controller making the big decision and lots of battery monitoring and balancing integrated circuits (BMB ICs), which look after groups of cells. These BMB ICs collect information from voltmeters, thermometers and other sensors in the pack and send that information to the main controller, which can act accordingly, like turning the cooler on if the battery is too warm. The issue is that these cells typically look after 10-20 cells each, and those familiar with electric cars will know that some can have thousands of cells: the result is lots of BMB ICs throughout the pack. IDTechEx’s research finds that, although power electronics are such a hefty set of components, the battery management system makes up approximately one-third of the silicon demand used to make electric powertrains.

Nothing ever stands still in the rapidly evolving world of semiconductor technologies and the BMS is not immune from semiconductor trends either. As stated above, BMB ICs are capable of monitoring between ten and 20 cells within the pack, but this number is growing. This is likely thanks to the gradual move to more advanced silicon processes giving more powerful and more capable chips. The effect of this is a reduction in chips required throughout the battery pack. This is compounded by trends towards fewer cells per vehicle, enabled by growing cell capacities.

Electrification, as well as automation, are epoch-defining transitions for the automotive industry and bring with them new and quickly developing semiconductor markets. Although this article is mainly concerned with the battery management system, “Semiconductors for Autonomous and Electric Vehicles 2023-2033” gives a holistic and comprehensive coverage of semiconductors throughout the car, including ADAS, autonomy, LiDAR, radar, cameras, 4G connectivity, 5G connectivity, electric powertrains, MCUs, SOCs and more. IDTechEx can help businesses understand all of the new technologies coming to vehicles, the technologies on the horizon, and how the evolving automotive industry is going to impact semiconductor markets.