Jun 14 2009

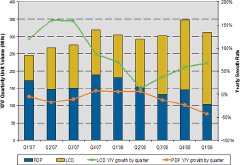

While "flat is the new up" for many technologies as the global recession continues, current results show that the flat-panel digital signage market continues to grow with larger-size commercial LCD products outpacing shipments of commercial plasma products 2-to-1 in Q1'09. Results from the recent DisplaySearch Quarterly FPD Public Display Shipment and Forecast Report revealed that Q1'09 worldwide shipments of larger size (26"+) flat panel displays used in commercial applications for out-of-home environments grew 2% Y/Y, but dropped 10% Q/Q showing that this market may not be completely impervious to the effects of the global recession. Further analysis revealed that this market segment is still healthy, however.

Table 1: Q1'09 Worldwide Market Share Brand Leaders and Technology Splits for 26"-plus Large-Format FPDs

Table 1: Q1'09 Worldwide Market Share Brand Leaders and Technology Splits for 26"-plus Large-Format FPDs

Sequential declines seen in the period came more as a result of fewer plasma shipments in the quarter due to some production transitions in that sector rather than falling demand. Conversely, LCD-based commercial displays saw a 3% sequential growth for the period and an astounding 67% growth when compared to the same period as last year.

"While LCDs continued to gain momentum as an acceptable Out-of-Home (OoH) flat panel display technology with phenomenal Y/Y growth of 67%, plasma-based technologies were unable to take advantage of their price/size advantage in 50"+ sizes, thus shipments fell 37% in the same period," noted Chris Connery, Vice President of PC and Large Format Commercial Displays. "Looking ahead, plasma looks to re-gain its strong foothold on the commercial FPD space as more production capacity--allowing for larger size displays to be produced even more efficiently start to come on board potentially even butting-up against other OoH technologies such as direct view LEDs and Rear and Front Projection systems in indoor venues."

Some major brands stopped promoting plasma as a technology for commercial applications in 2008 and such movements no doubt hurt public perception of the technology. Major players such as Panasonic are still quite focused on the technology and are preparing for an annual refresh of their professional line of products as well as expanded capacity, which indicates that this technology is far from being out of contention as a strong competitor in this space. DisplaySearch's results indicate that in spite of the drop off in Q1'09 WW total shipments for FPD technologies for commercial environments, Panasonic was the #2 brand for the quarter for large format commercial displays, behind #1 Samsung in total FPD commercial market share. (Table 1)

Looking forward, the display market will help drive market momentum around digital signage. Fabrication plants for larger LCDs and plasma products are will come on-line in 2009 and 2010 with sizes and technologies geared more towards Out-of-Home environments than traditional in-home TV display sizes. Other technologies such as various forms of front and rear projection are still prepared to combat the continued onslaught of FPD technologies as well (especially tiled LCD and PDP solutions) with new innovations on the horizon.

DisplaySearch Quarterly FPD Public Display Shipment and Forecast Report includes worldwide shipment and forecast data for both LCD- and PDP-based FPD public displays by quarter through 2015 with historical shipments by brand, by size, by region for LCD public displays and historical PDP total worldwide shipments by size from Q1'06 through the present. This report also provides cost forecasts of LCD and PDP modules used in public display environments as well as projected average street prices by size and by technology through 2015. This report is delivered in PowerPoint and includes enhanced Excel data tables. For more information, contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, email contact (at) displaysearch (dot) com, or contact your regional DisplaySearch office in China, Japan, Korea or Taiwan.