Jul 8 2015

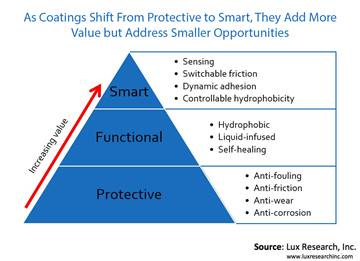

While coatings today provide protection and other static functionality, a new generation of technologies is making them "smart" – able to change in response to their environment. There's significant potential for this capability to impact industries from military and aerospace to medicine, according to Lux Research.

“Smart coatings are coming and will open the way to more dynamic, higher performing products,” said Anthony Schiavo, Lux Research Associate and lead author of the report titled, “Surfaces Get Smarter: Scouting Emerging Coatings, Markets and Functionalities.”

“However, many of these innovations are still at the lab stage and face technical and developmental challenges before they can make an impact in the market,” he added.

Lux Research analysts evaluated the technical and market potential of both functional and smart coating technologies and developers. Among their findings:

Partnerships, scale are key to hydrophobic coatings. Clear winners emerging in the hydrophobic coatings space are set apart not by performance metrics but by their ability to form partnerships and scale technology. In automotive coatings, Nanogate Technologies is far above the field, followed by Diamon-Fusion; P2i and HZO lead in electronics.

LiquiGlide leads in liquid-infused coatings. Liquid-infused coatings have rapidly emerged on the back of low cost – less than $1/m2 – and are now positioned to impact packaging. The two main start-ups in this space – LiquiGlide and SLIPS Technologies – employ similar technology but LiquiGlide has the edge because of its greater maturity and a partnership with Elmer’s.

Self-healing coatings are still sluggish. Self-healing coatings have suffered from slow growth but market pull and patenting activity indicate a future for this technology. Key products in the market include Nissan Motor’s self-healing car paint and LG Electronics’ self-healing back coating for its G Flex 2 smartphone.