Researchers from the Qingdao University of Science and Technology have published a new paper in the journal Sustainability to investigate the optimal model that could help inform decisions in designing supply chains. This will consider different climate change mitigation regulations on carbon emissions and companies.

Study: Which Is the Best Supply Chain Policy: Carbon Tax, or a Low-Carbon Subsidy? Image Credit: Elnur/Shutterstock.com

Low-Carbon Supply Chains

Climate change is a pressing existential threat, with several technological solutions proposed to keep global temperature rises within acceptable and safe levels. Furthermore, international agreements and regulations enacted by many world governments have been proposed to phase out fossil fuels and reduce the number of carbon emissions produced by industrial and commercial activity.

Low-carbon supply chains have become a key focus in climate science in recent decades. This has been driven in part by changes in consumer preferences, and consumers are increasingly demanding low-carbon products. Without regulation, however, many companies may choose more environmentally harmful production and manufacturing processes in certain circumstances.

Decreasing the impact of supply chains requires the cooperation of governments and retailers too. Incentive systems and carbon market control can improve social well-being, with low-carbon promotion helping to meet carbon reduction targets and provide social and economic benefits.

Optimal decision-making processes depend on several factors, and there are several elements to the ideal low-carbon supply chain. This area of research focuses on green supply chains, dual-channel supply chains, and optimal decision-making.

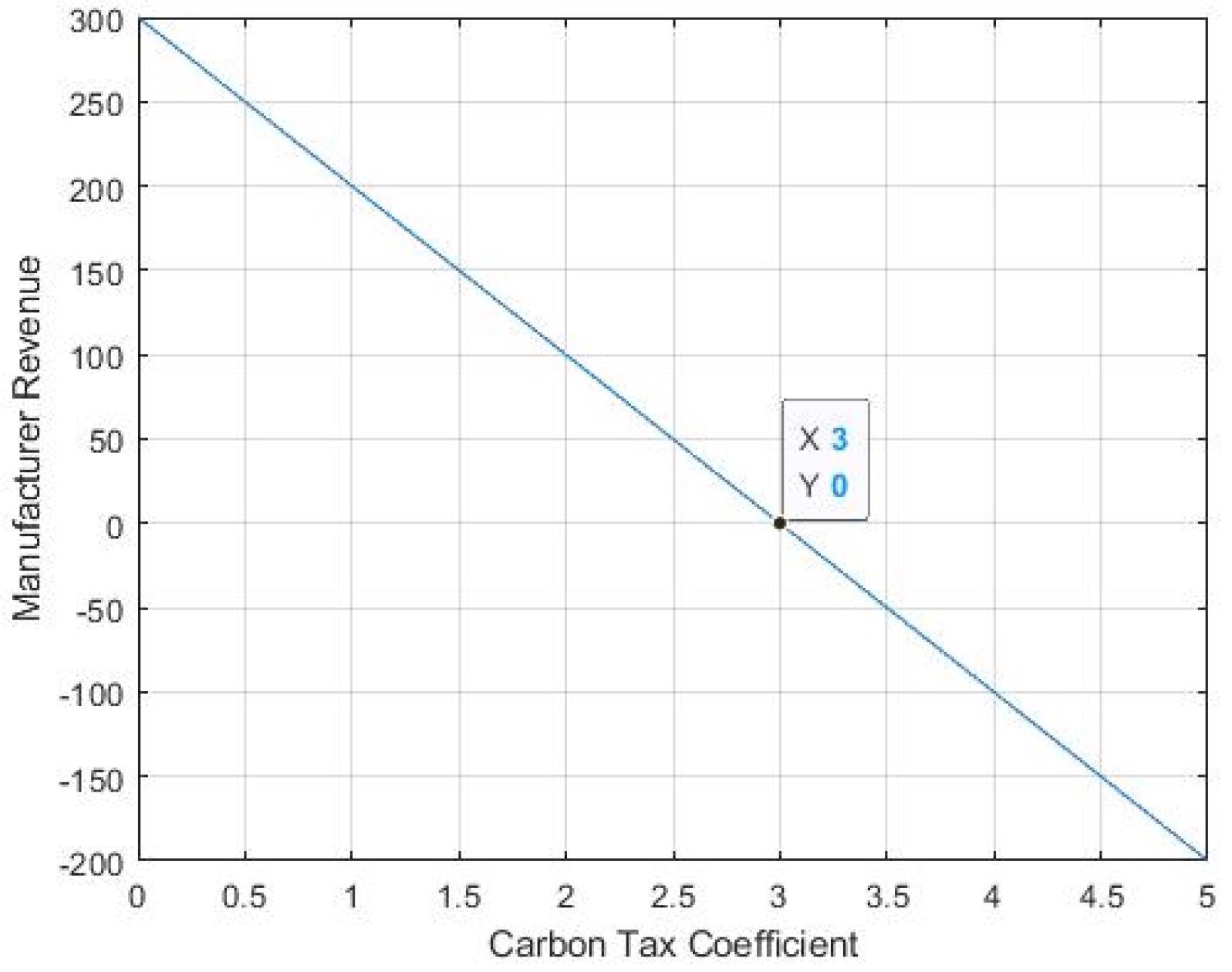

The effect of the carbon tax coefficient on manufacturer earnings. Image Credit: Wu, L et al, Sustainability

Carbon Tax: An Appropriate Policy?

A carbon tax has been widely proposed as a strategy to promote a low-carbon approach in industry. However, this strategy, whilst it favors the reduction of carbon emissions and embodied carbon in products, can be too simplistic an approach and potentially even damaging, as it does not consider the economic ramifications for producers. Excessive taxation can hinder economic growth.

A different approach may be better than simply taxing end products. Policies that include low-carbon subsidies can mitigate the impact of increased enterprise costs for business, in turn stimulating innovation and investment in the commercial sector. Moreover, it could raise the ambitions of low-carbon enterprises. Unit progressive carbon prices and progressive tax rates could do more to motivate companies than flat rates of taxation to participate in green incentives.

Whilst the adoption of subsidy policies would benefit producers, retailers, and consumers, help to reduce carbon emissions, and mitigate the damage caused by anthropogenic climate change, there has been a lack of study focusing on subsidies between supply chains. There has also been a lack of systematic and comprehensive analysis of emission reduction strategies, low-carbon supply chains, and decision-making processes in supply chains.

The Study

The study aims to provide a comprehensive and systematic analysis of strategies to optimize decision-making to achieve low-carbon supply chains. Three regulatory policies have been compared in the research to build an optimal model for decision-making: carbon taxes on their own, a subsidy approach, and a dual, combined policy that incorporates both carbon taxes and subsidies.

The three policy types and their impact on retailer and manufacturer income, marginal profit, and carbon emissions has been extensively explored by comparing the three models to elucidate that with the most positive and holistic effect. A total of forty-five papers covering various aspects of the research question have been analyzed by the authors behind the study.

Three key issues have been explored in the paper. Firstly, the authors aimed to elucidate the best model. Secondly, the research aims to discover which policy leads to the greatest carbon emissions reduction. Thirdly, the authors sought to find a link between carbon tax coefficients and subsidy rates, manufacturer income, and carbon emission reduction rates.

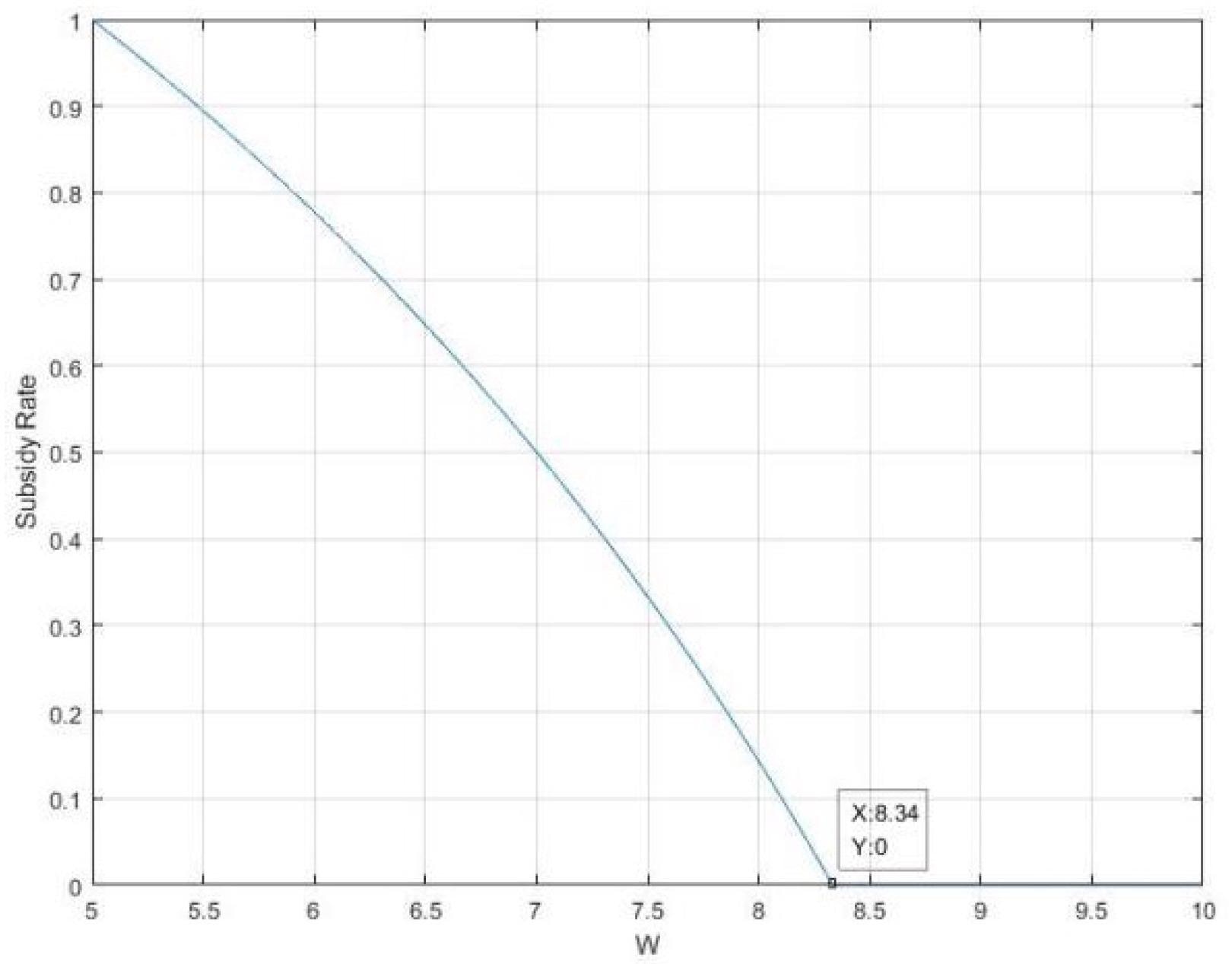

The effect of wholesale price on subsidy rate. Image Credit: Wu, L et al, Sustainability

Research Findings

The authors have presented several key findings and recommendations in the paper. These findings are intended to steer more effective supply chain carbon reduction policies in the future.

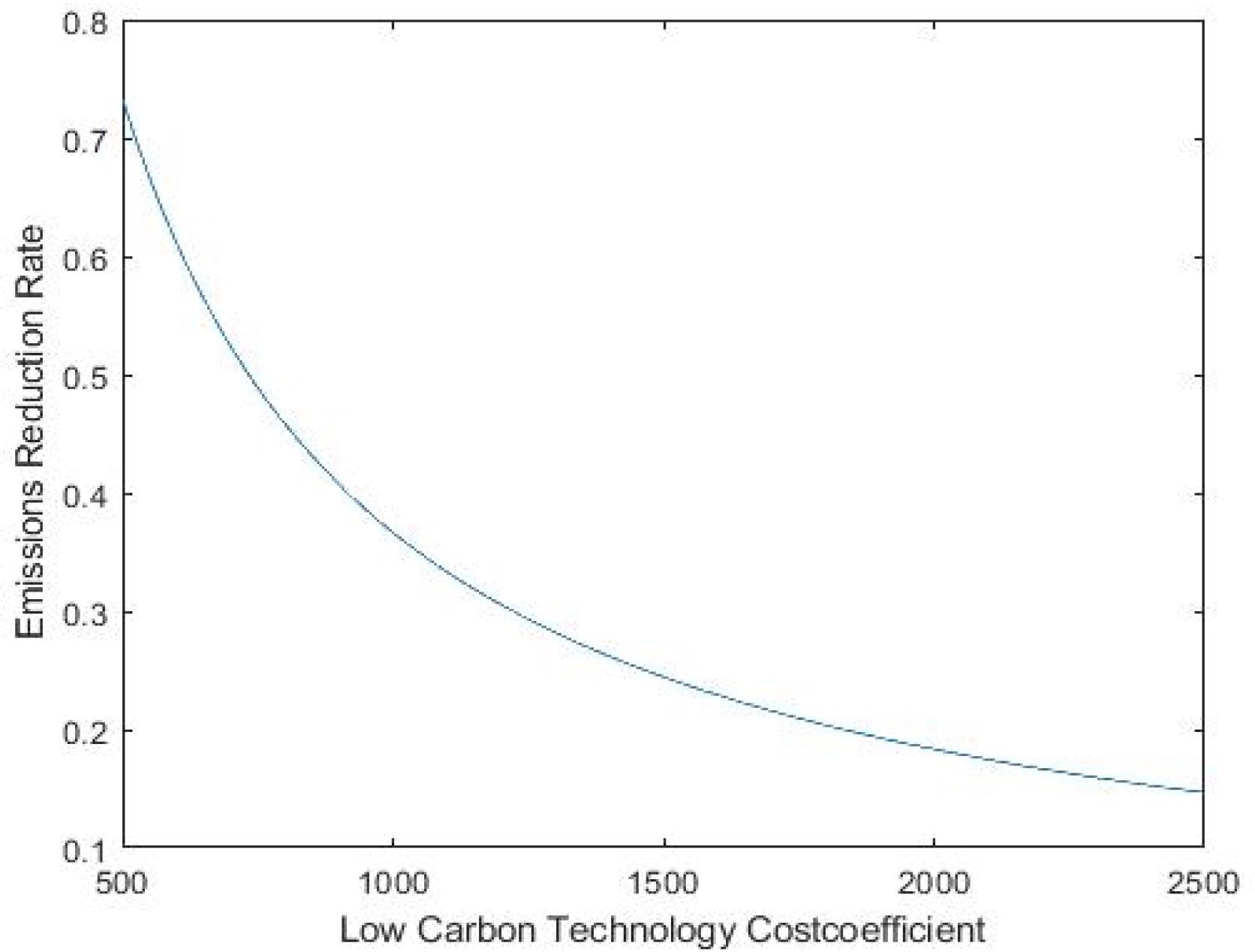

The research found that carbon taxes have a negative effect on the profitability and enterprising approach of companies. Whilst good for the environment, flat rates of tax damage manufacturers. Reasonable coefficients should be introduced by governments to reduce carbon emissions whilst protecting economic growth. Companies with higher greenhouse gas emission reductions should be offered larger subsidies.

The effect of the low-carbon emissions reduction coefficient on emissions reduction rate. Image Credit: Wu, L et al, Sustainability

Moderate subsidies can ensure the health of the economy in the medium-to-long term. Retailer subsidies and the manufacturer’s rate of carbon reduction can be affected by increased coefficients, with retailer income increasing marginally before rapidly declining. There is a negative linear relationship between increased coefficients and manufacturer income. These are incredibly burdensome, and costs tend to be passed on internally.

Reasonable carbon tax collection standards must be implemented by governments, and they must offer moderate low-carbon subsidies to enhance economic growth and social welfare. Balancing both will have beneficial effects on both the environment and the economy.

The optimal model presented in the research can be used by companies to meet their social responsibilities whilst ensuring they still make a profit.

Further Reading

Wu, L et al. (2022) Which Is the Best Supply Chain Policy: Carbon Tax, or a Low-Carbon Subsidy? Sustainability 14(10) 6312 [online] mdpi.com. Available at: https://www.mdpi.com/2071-1050/14/10/6312

Disclaimer: The views expressed here are those of the author expressed in their private capacity and do not necessarily represent the views of AZoM.com Limited T/A AZoNetwork the owner and operator of this website. This disclaimer forms part of the Terms and conditions of use of this website.